Redesign Your Home Office with Personal Loans: A Guide

Do you feel unproductive in a dull, inefficient home workspace? As remote work rises, having an optimal home office becomes more vital. However, major upgrades frequently demand hefty budgets. Is there financing to build your ideal workspace without collateral or exorbitant renovation fees? Personal loans provide rapid, adaptable funding to construct a purposeful, inspiring home office without entirely overhauling your house or overspending.

With reasonable rates and terms, you can strategically revolutionize your home workspace to maximize comfort and productivity. This guide examines employing personal loans to intelligently enhance your home office through lighting, layout, furniture, storage, and technology upgrades for the contemporary remote employee. Strategic borrowing enables you to boost efficiency and inspiration in your everyday work environment.

Chapters

The Viability of Personal Loans

Personal loans for home office renovations have surged as remote work fuels redesign needs. These affordable loans empower 24% of homeowners to upgrade workspaces without tapping savings or home equity. Approval happens swiftly given moderate interest rates, averaging 10.13% APR.

You can get approved for affordable financing ranging from $5,000 to $35,000 through online lenders and banks. Before applying, you can see if you pre-qualify for a personal loan to estimate potential rates and terms, unlocking the flexibility and affordability needed for your home office redesign. Personal loans provide more flexibility compared to home equity loans or lines of credit (HELOCs), which use your property as security for the loan.

Some key advantages of personal loans

Faster Approval Time: Online lenders approve in 24 hours, while home equity lines require 30 days. Receive funding rapidly through personal loans.

Lower Interest Rates: Average personal loan rates of 10.13% APR undercut home equity’s 5.93% rates, saving on interest fees.

No Collateral Required: Personal loans don’t stake your home as collateral. Defaulting payments on home equity loans risk property seizure.

Personal loans enable fast, adaptable financing, preserving full home ownership. Still, contrasting loan specifics like rates, terms, and lender reputability before borrowing optimizes decision quality regarding the best value for home office upgrades.

Evaluating Your Needs and Loan Options

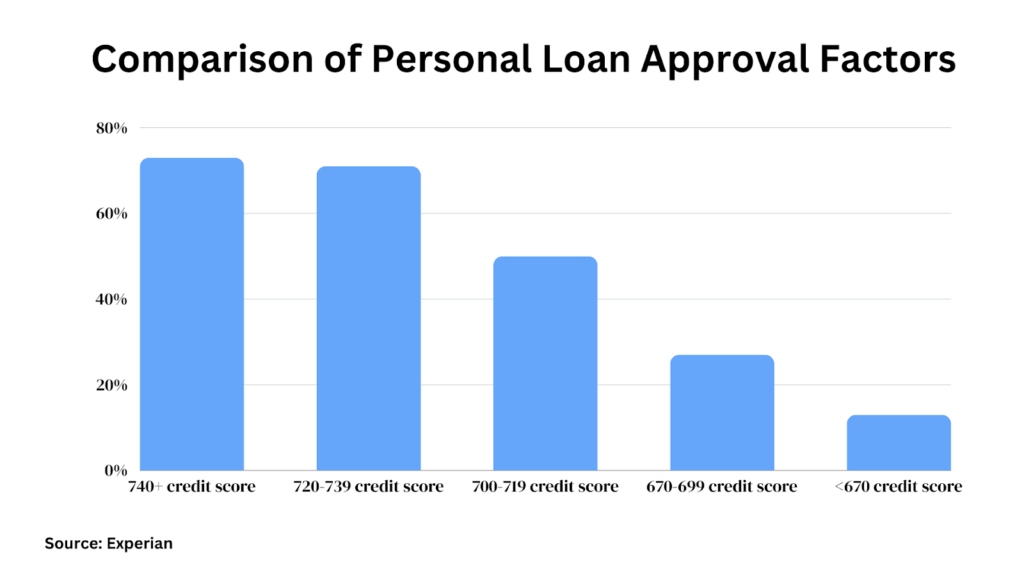

Average remodeling costs thousands of dollars, and major electrical or layout overhauls may run even higher. Personal loan rates range from 6% to 36%, depending on credit score, income, and finances.

Contrasting loan offers save $1,500 on average, given variable lender rates and fees. Online approvals require 24 hours, while banks need weeks. Evaluating rates and lenders facilitates informed financing decisions for optimal office remodeling loans.

Before picking a loan, create a budget by adding up costs for materials, labor, new furniture, etc. Factor in an extra 10% for unexpected expenses. This helps you borrow the right amount without shortfalls or overborrowing. Inspect your credit report and address any errors to qualify for better rates. Research multiple lenders and loans to find the best financing fit for your project and budget.

Strategic Planning for Loan Application and Repayment

Getting the best personal loan rates below 12.17% requires good credit (usually 720+ FICO scores). Keeping your debt-to-income ratio under 43% also improves approval odds and terms.

Over 80% of approved applicants have a solid repayment plan that accounts for new loan payments plus existing monthly expenses. Careful budgeting is essential since home office projects can take months.

It’s wise to compare monthly payments over different loan terms and choose the one that fits your budget best:

- 3-year terms have higher monthly payments but less interest paid over the loan.

- 5-year terms have lower monthly payments but increased total interest costs over time.

Mapping out a realistic repayment strategy prevents financial strain down the road. The key is budgeting properly for the loan payments in alignment with your current finances and income stream.

Managing Loan Funds and Project Execution

Borrowers often have loan money sent straight to contractors, which helps projects stay on schedule. However, home remodels frequently deal with delays and end up going over budget. Using apps to track what you spend can help ensure you stick to your budget. Remember, if the work takes longer, you pay more overall in interest charges. Frequently updating contractors helps avoid timeline issues and extra costs. Clear and regular communication with contractors is crucial to finishing on time and not going over what you planned to spend.

Ideally, have loan funds distributed in phases based on work milestones. Paying for each stage as it’s finished motivates timely deliverables. Monitoring contractor invoices against your app ensures transparency. If certain materials or tasks exceed estimates, you can discuss adjustments with contractors immediately rather than discovering overages after it’s too late.

Ask contractors to provide monthly progress reports and budget forecasts. This allows you to assess timeliness and budget adherence. Voice any concerns directly to prevent uncontrolled spending. Managing distributions, tracking expenditures, and communicating with contractors help remodeling projects meet schedule and budget goals.

Final Thoughts

Personal loans can provide affordable financing for home office renovations and enhancements. They offer the upfront cash needed to upgrade ergonomics, technology, and aesthetics to meet your needs. Managing funds diligently and communicating with contractors helps ensure on-time, on-budget project completion.

With responsible borrowing and repayment of a personal loan, you can transform your home office into a functional space that unlocks productivity without breaking the bank. Well-planned loans for strategic renovations prove a worthwhile investment in optimizing comfort, creativity, and efficiency in your homework environment over the long run.

Frequently Asked Questions

- What happens to my credit score if I take out a home office loan?

As an installment loan, paying it back on time can improve your credit rating. However, missing payments damages your score. Checking your credit during and after repayment is smart.

- How much should I borrow to remodel my home office?

Total up all costs—materials, labor, and furniture. Then add 10% as a buffer. This gives you the complete projected amount needed. Apply for a loan that covers the full estimate. That way, you won’t come up short.

- What can I do to stay on track with loan payments during renovations?

Set up automatic payments from your bank account so you never miss or forget a payment. Tracking project timelines and expenses may reveal areas to adjust. Aligning repayments with outflows helps everything flow smoothly.

Create more and better content

Check out the following resources and Grow!